Aggressive Investment Portfolio Find The Idea Here

In its best year it might gain 30-40. In The Intelligent Investor Benjamin Graham provides criteria for building an aggressive investment portfolio.

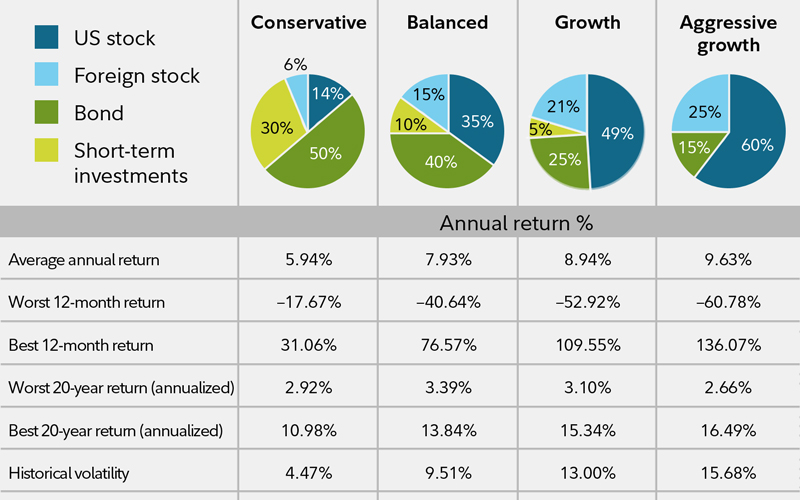

With a roughly 50 equity position and the remainder in cash and bonds the portfolio is more stock-heavy than other.

Aggressive investment portfolio. The returns can fluctuate widely from a negative to a high positive. Aggressive investment strategy matches young investors who are interested in taking higher degrees of risk to maximize return. Greg Hoffman outlines the strategy benefits and risks.

When it comes to the aggressive end of the spectrum theres really no limit to how much risk you can take. Aggressive portfolios are most appropriate for investors in their 20s 30s or 40s because they typically have decades to invest and recoup any losses they may experience. When you go to your local grocery store you grab a shopping basket.

However she expects that stocks will rise in the next five years because of a. The Aggressive Risk Portfolio is appropriate for an investor with a high risk tolerance and a time horizon longer than 10 years. Read more about aggressive investing and building an aggressive investment portfolio.

This Aggressive Bucket Portfolio is composed of traditional mutual funds. Do you like to see aggressive growth in your portfolio. These types of portfolios employ many investing strategies across various asset classes.

By Greg Hoffman. An aggressive investor wants to maximize returns by taking on a relatively high exposure to risk. They invest to maximize capital appreciation or increase the portfolios value over the long term rather than regular income or safety.

You may be an aggressive investor. As a result an aggressive investor focuses on capital appreciationinstead of creating a stream of income or a financial safety net. An aggressive portfolio is appropriate for an investor with a high risk tolerance and a time horizon longer than 10 years.

An aggressive portfolio is ideal for someone who is just starting out and wants to build their nest egg over time. Aggressive investors should be willing to accept periods of extreme ups and downs in exchange for the possibility of receiving higher relative returns over the long term. Tactical asset allocation involves taking an active approach to the percent of a portfolio in any particular asset class based on expected market conditions.

It does not mean that they speculate. You could go even further by funding it all with borrowed money. The grocery basket analogy Here is an analogy that explains exactly how asset allocation works.

You need to be prepared to accept that this option could experience negative returns over the short to medium term. An Aggressive Portfolio Aggressive portfolios mainly consist of equities so their value can fluctuate widely from day-to-day. Aggressive Portfolio This aggressive portfolio has 80 invested in a variety of equity funds 10 in bonds 5 in real estate and 5 in gold.

An aggressive investment portfolio follows strategies of aggressive investors who spend a lot of time doing meticulous research on their stocks. A portfolio consisting of 100 shares is aggressive but you can take it up a notch by focusing in on say junior mining stocks. Aggressive Portfolio Strategies Aggressive Growth Mutual Funds are a simple way to invest in stocks in an indirect way where you will not have to monitor the individual stocks for rebalancing.

Do you mind a little risk. A sound asset allocation strategy ensures your investment portfolio is diversified and aggressive enough to meet your savings goals without unnecessary risk. Therefore a portfolio using this model would have a higher weight of stocks and equities.

For example a 45 year old may have 60 of her funds invested in equities. An aggressive portfolio might average 7-10 average rate of return over time. If you have an aggressive portfolio your main goal is to achieve.

Aggressive investing strategies emphasize capital appreciation over protecting capital. Aggressive portfolios typically include more stocks than moderate and conservative portfolios so they tend to produce greater volatility than other types of portfolios that hold lots of fixed investments like bonds. Alternative investments The slump in the gold sector provides an opportunity to add some alternative investments to our Aggressive Portfolio.

Aggressive If you are a long-term investor and want exposure to investment groups that will potentially give higher returns Aggressive may be suitable for you. If youre just getting use to this type of investing you might wonder what. In its worst year it could decline by 20-30.

Aggressive Investor Finance Saving Investing Money Today

How To Construct An Investment Portfolio Ntellivest Investment Portfolio Investing Invest Wisely

Does It Pay To Keep An Aggressive Portfolio The Couch Potato Has Some Facts To Share About This Aggressive Investing Couch Potato

What Is A Roth Ira Roth Ira Investing Money Dave Ramsey Investing

If You Re Managing Your Own Ira Portfolio When You Retire You Can Use These Model Stock And Bond Mixes As Your Guide Smart Money Go It Alone Annuity

Best Etfs For Your Investment Portfolios Investment Portfolio Investing Ishares

Finding The Right Asset Allocation Portfolio Management Investing Retirement Portfolio

Pin By Oluwashina Atere On Technology Investment Portfolio Investing Portfolio

Aggressive Investment Strategy Investing Financial Strategies Portfolio Strategy

How To Protect Your Retirement Savings Fidelity Investment Portfolio Investing Retirement Income

Aggressive Investing Investing Best Way To Invest Mutual Funds Investing

How To Achieve Optimal Asset Allocation

Algorithmic Trading Evaluation Report For Aggressive Stocks October 2019 Genetic Algorithm Stock Market Forecast Artificial Neural Network

Types Of Portfolios Money Management Advice Business Money Finance Investing

Seeking Professional Investment Management Witihout Transferring Your Funds Expert Futureadvisor Review Free Portfolio Revie Robo Advisors Advisor Investing

What Are The Differences Between Aggressive And Conservative Financing Strategy Investing Strategy Financial Strategies All About Insurance

Recommendation For A Moderately Aggressive Portfolio With Option Enhancement Feel Free To Request Clarification Mo Portfolio Management Investing Portfolio

Asset Allocation Wealth Management Wealth Management Services Portfolio Management

Investment Portfolios What S Up My Masters Let S Talk About Investment Portfolios Now There Is No Such Thing As A One Size Fits All When It Comes To A

Post a Comment for "Aggressive Investment Portfolio Find The Idea Here"