Aggressive Investment Strategy Example Which is Very Interesting

Projections can also help an investor determine the most appropriate level of saving while accumulating or spending from. Aggressive Mutual Fund Category Example A typical aggressive portfolio asset allocation is at least 80 stocks but finding one with 8590 in stocks isnt uncommon in younger individuals.

Diversifying Investments Mix Of Stocks Bonds More Fidelity

ATO Investment Strategy requirements.

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

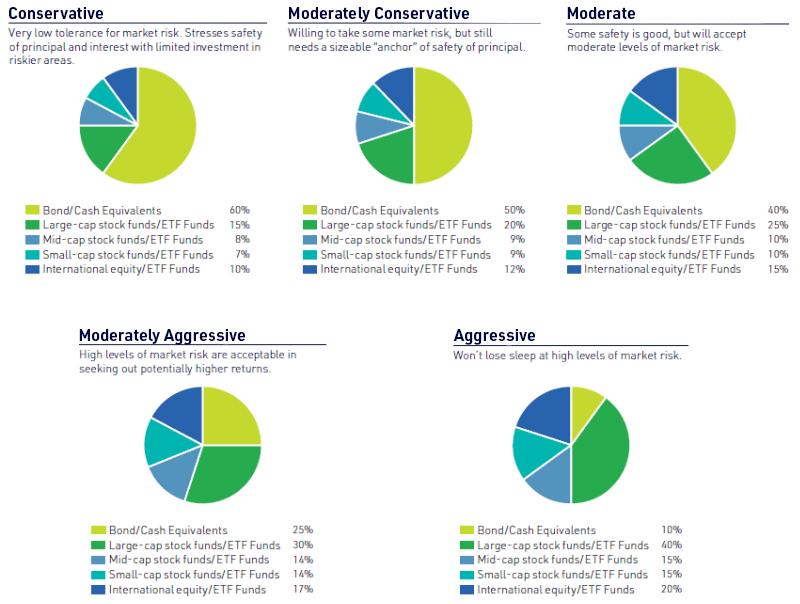

Aggressive investment strategy example. For example government bonds along with safe-haven assets are the preferred investment vehicles for a conservative investor. For example a young investor with small portfolios and longer time horizons is typically an aggressive investor. She then augments it with a cash bucket that she uses for.

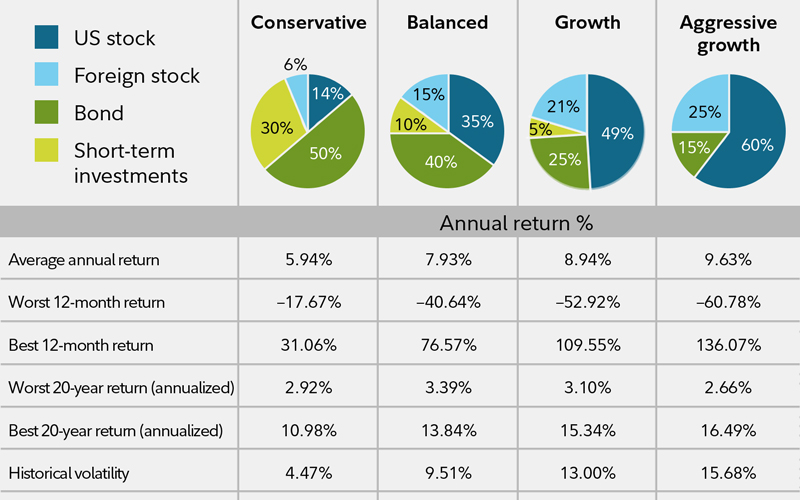

And finally a balanced portfolio is you guessed it a balance between conservative and aggressive mindsets. When the strategy is aggressive the chances of exceeding a high goal are higher good but the chance of exceeding a low goal is lower bad. Summaries such as this can help investors make the difficult choices that lie at the heart of investment decision-making.

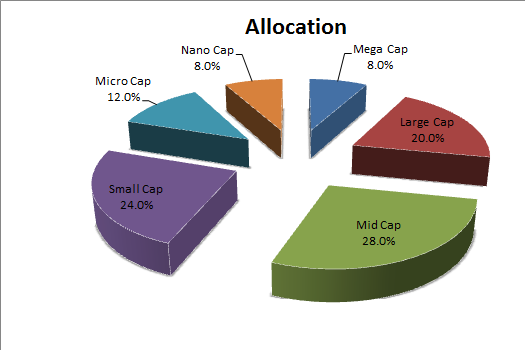

Theres variation within these two groups for example a swing-for-the-fences aggressive portfolio may feature high-growth small-cap stocks while a less risky aggressive portfolio may focus more on blue-chip stocks. Investing in a way to maximise member returns taking into account the risk associated with the investment. Volatility and risk are strongly connected.

An aggressive investment strategy weights a portfolios composition primarily on a combination of moderate- to high-growth stocks with much smaller portions of bonds and commercial paper. Some ETFs employ aggressive investing strategies which often involves leveraging the portfolio. This arrangement involves a higher-than-average level of risk and price volatility which investors accept prior to implementation.

Aggressive investing strategies emphasize capital appreciation over protecting capital. These types of portfolios employ many investing strategies across various asset. So if the value of the underlying securities in the ETF go.

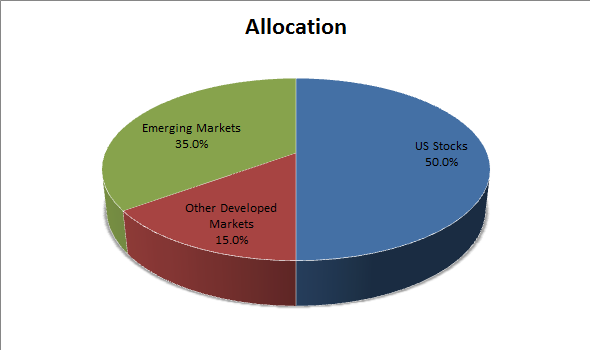

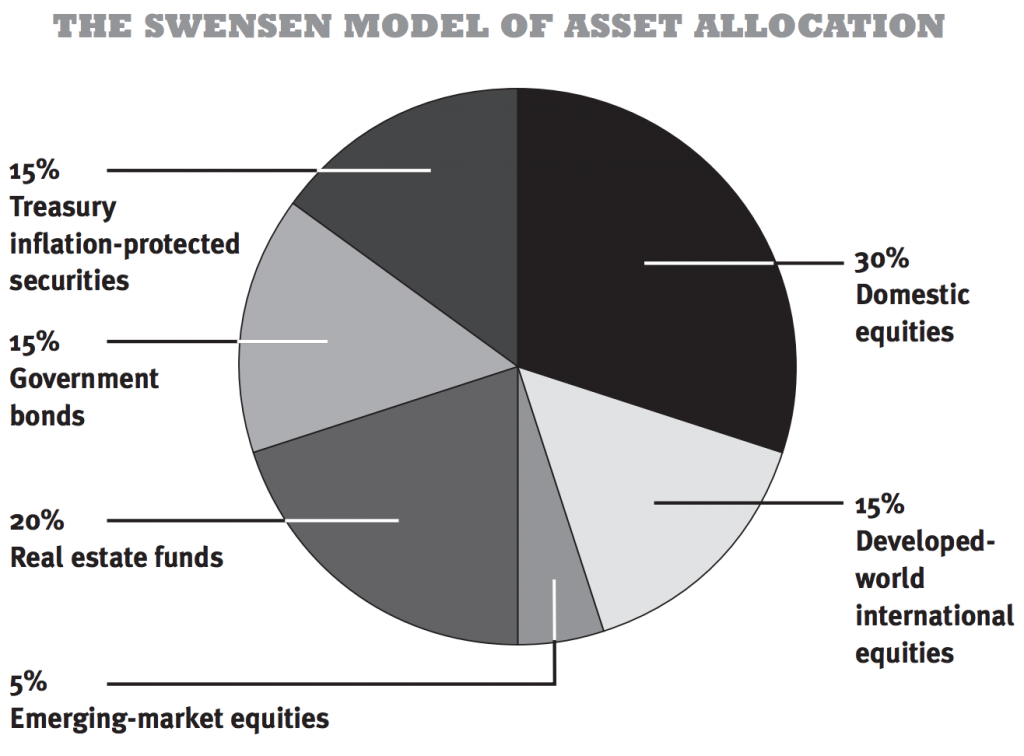

Diversification and the benefits of investing across a number of asset classes for example shares property and fixed deposit in a long-term investment strategy. The ATO requires that SMSFs have a documented investment strategy that considers. A standard example of an aggressive strategy compared to a conservative strategy would be the 8020 portfolio compared to a 6040 portfolio.

A good rule of thumb is to subtract your age from 110 and have that percentage of your portfolio in stocks. A longer time horizon is needed to allow time for investments to recover in the event of a sharp downturn. Aggressive Portfolio This aggressive portfolio has 80 invested in a variety of equity funds 10 in bonds 5 in real estate and 5 in gold.

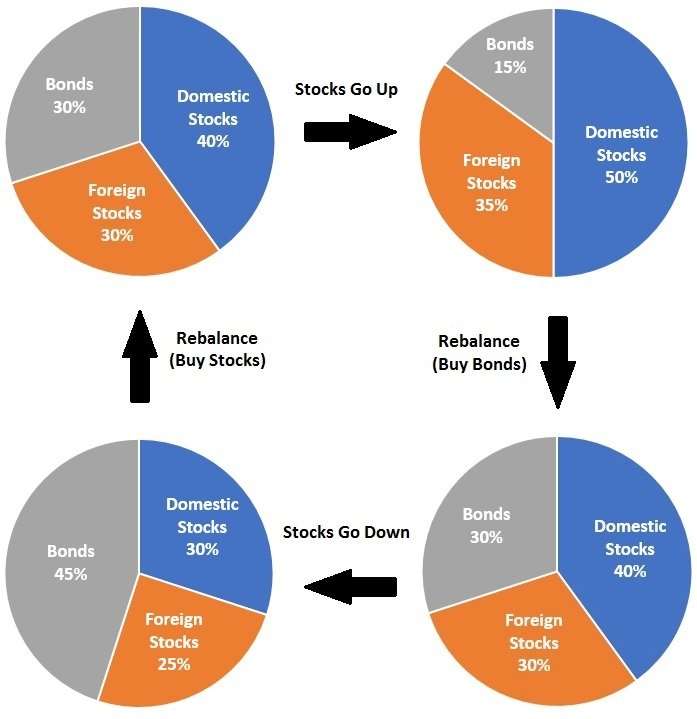

A longer time horizon allows the portfolio to recover from potential fluctuations within the market. The basic strategy is that a retiree holds the bulk of her assets in a long-term portfolio thats diversified between stocks and bonds. An 8020 portfolio allocates 80 of the wealth to equities and 20 to bonds compared to a 6040 portfolio which allocates 60 and 40 respectively.

Aggressive investors should be willing to accept periods of extreme ups and downs in exchange for the possibility of receiving higher relative returns over the long term. Financial professionals usually dont recommend aggressive investing for anything bu a small portion of a nest egg. On the other hand and aggressive investor will choose stocks commodities ETFs or currencies which have a higher risk and are more volatile.

Aggressive Trading Strategies How To Chase Profits In Any Market

A Detailed Diversification Strategy Part Ii The Aggressive Investor Seeking Alpha

Asset Allocation The Ultimate Guide For 2021

A Detailed Diversification Strategy Part Ii The Aggressive Investor Seeking Alpha

3 Simple Diversified Investment Portfolios For Long Term Growth

Aggressive Investment Strategy

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-02-a789b19993bb400f801df6ca72b9f2ea.png)

How To Achieve Optimal Asset Allocation

Choosing An Investment Strategy Wea Member Benefits

Asset Allocation The Only Thing That Matters In Investing

A Detailed Diversification Strategy Part Ii The Aggressive Investor Seeking Alpha

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

How Tactical Asset Allocation Works With Example Portfolios

:max_bytes(150000):strip_icc()/AchieveOptimalAssetAllocation-04_2-dbcdce95e61347e5bdd2df3bfabb4023.png)

How To Achieve Optimal Asset Allocation

Diversified Portfolio Examples I Will Teach You To Be Rich

Asset Allocation The Ultimate Guide For 2021

/AchieveOptimalAssetAllocation-01_2-8450dfb785a04b43b234ca4c050396db.png)

How To Achieve Optimal Asset Allocation

A Detailed Diversification Strategy Part Ii The Aggressive Investor Seeking Alpha

Post a Comment for "Aggressive Investment Strategy Example Which is Very Interesting"