Am Investment Unit Trust Get Free Info

A Unit Trust apportions trust assets according to units. Therefore you own 75 of the Unit Trust assets.

What S Unit Trust And How Is It Important As A Saving And Investment Tool Kclau Com

Trusts can be small or they can be very large.

Am investment unit trust. A unit trust is a popular structure for holding property and other investments and this article examines numerous methods of how an SMSF may invest in a range of unit trusts. What is a unit. Basically it is a basket of stocks or equity funds bond funds that invest in corporate bonds money market funds which invest into the money instruments REIT funds and property funds.

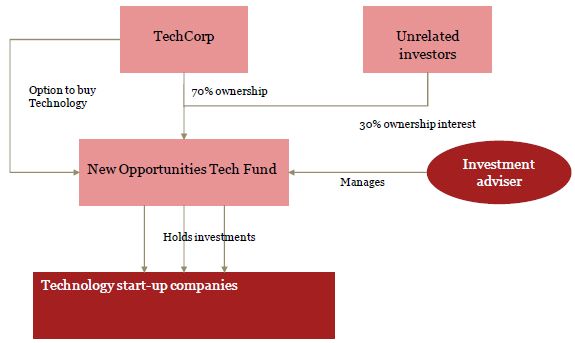

Unit trusts are often used where unrelated parties run a business together and where the units are then held by a family trust and for managed funds where investors hold units in the trust. An SMSF can invest in unit trusts but the rules around doing so vary and need to be considered with the legal risks that accompany these investments. Unit Trusts are an investment vehicle that allows for multiple investors to share ownership of a specific investment or portfolio of investments often property.

A unit is a piece of property that entitles the unit holder to a specified proportion of the income and capital of the trust. Ad Discover New Opportunities in Both Local Global Stock Markets. Join our Vibrant Trading Community and Discuss Market Trends in Real Time.

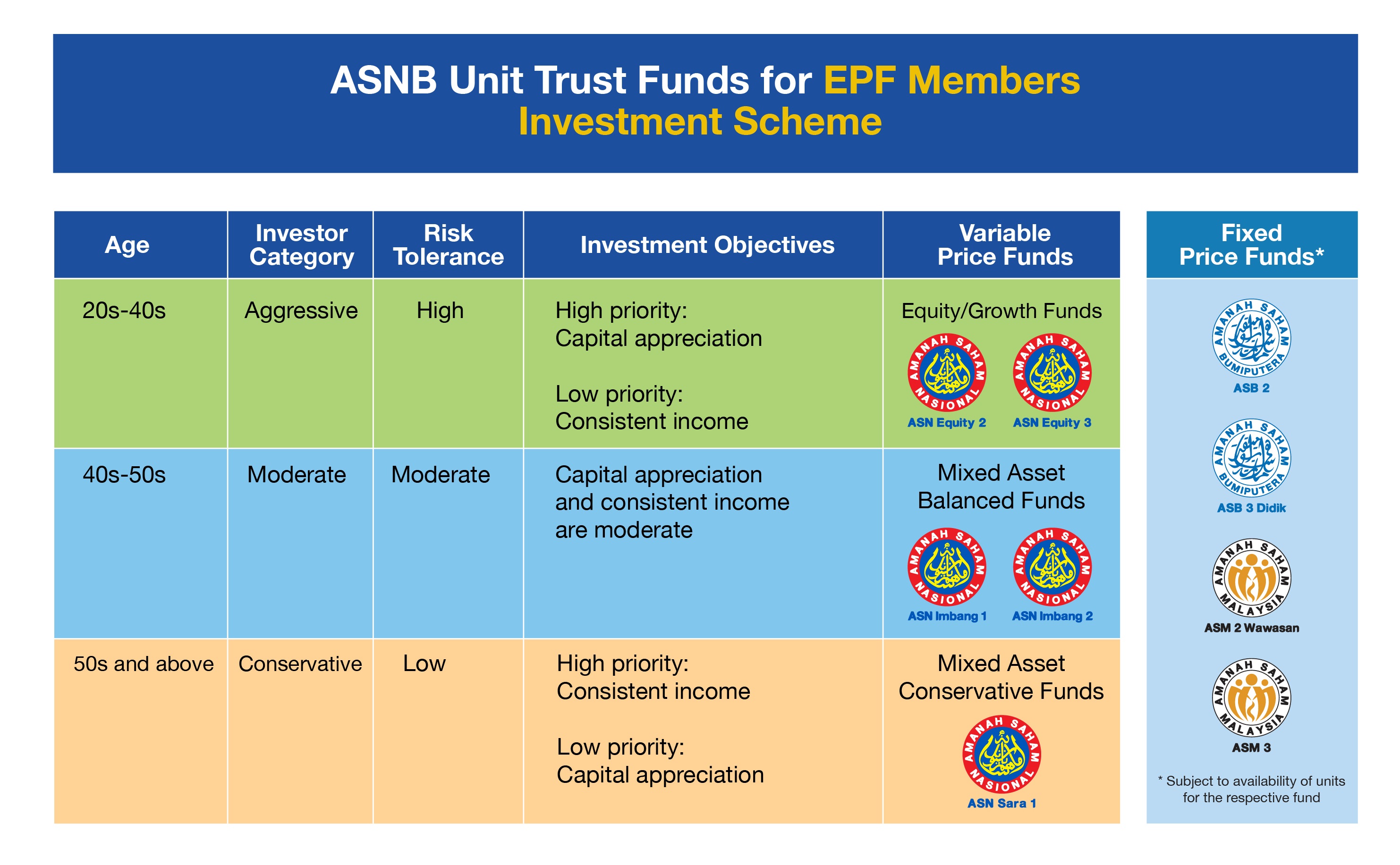

Price for 04 December 2015 For Closing on 03 December 2015 Every Monday and Wednesday Valuation Every Wednesday Valuation Price of 2 preceeding business days New Fund This is the list of unit trust funds qualified under EPF MIS subject to annual review by EPF for the. A unit trust is a portfolio that invests into all the investment instruments I mentioned. Daily Fund Prices.

Investors should read the prospectus carefully before investing which contains a detailed explanation of the investment objectives risks charges and expenses. Join our Vibrant Trading Community and Discuss Market Trends in Real Time. Investors should consult their accounting legal or tax advisor.

As a Unit Holder you get beneficial ownership of trust property according to the number of units you own. Professional fund managers then use this pooled money to acquire investments they consider will help meet those objectives. While in legal terms a trust is a relationship not a legal entity trusts are treated as taxpayer entities.

Ad Discover New Opportunities in Both Local Global Stock Markets. A unit trust is an unincorporated mutual fund structure that allows funds to hold assets and provide profits that go straight to individual unit owners instead of reinvesting them back into the. Some of the managed investment unit trusts have more than 20000 unit holders or beneficiaries.

Unit trusts can help diversify an investment portfolio or provide access to an investment that. Other fees may apply. These investments are collectively referred to as the funds assets.

For more information on the above funds fees and charges cooling-off period and cooling-off right please refer to Prospectuses. Other fees may apply. They have limited application for most personal investments although some use them to hold property with the unitholder being a family trust.

A unit held under a trust is different from a share in a company. This is the list of unit trust funds qualified under EPF MIS subject to annual review by EPF for the period of 20202021 effective 1 April 2020 available at wwwkwspgovmy. For example you have 150 units and I have 50 units.

A unit trust fund is a vehicle which enables individuals corporations and institutions that have common investment objectives to pool their money. A unit investment trust UIT is an investment company that offers a fixed portfolio generally of stocks and bonds as redeemable units to investors for a specific period of time. Unit Investment Trusts UITs are sold only by prospectus.

Managed funds are run by investment professionals and come in a variety of forms including fixed interest property and equity funds or a combination of these. A trust is an obligation imposed on a person or other entity to hold property for the benefit of beneficiaries. Managed funds also known as unit trusts allow investors to pool their money with others thus enabling them to invest in assets and markets that may be difficult to access individually.

A share confers on the holder no. Trusts Trusts are widely used for investment and business purposes.

How I Make Money From Unit Trusts The Money Engineer

A Dummies Guide To Unit Trusts Andreyev Lawyers

A Unit Trust Is A Form Of Collective Investment Constituted Under A Trust Deed Money Management Advice Investing The Unit

Unit Trusts Frank By Ocbc Singapore

Posb Invest Saver Posb Singapore

Pricing And Performance Perpetual

Everyone Knows That You Have To Do Your Due Diligence Before You Invest In A Company Trust Some Put Their Full Trust In Fund Ma Told You So The Unit Investing

Practical Guide To Ifrs 10 Investment Entities Exception To Consolidation Accounting And Audit Malta

Unit Trusts Frank By Ocbc Singapore

Advantages And Disadvantages Of Family Trusts Ioof

Unit Trust Vs Savings 2 Trust Fund Savings Account The Unit

What S Unit Trust And How Is It Important As A Saving And Investment Tool Kclau Com

Smsfs Getting Practical To Invest In Land With Others

Amanah Saham Nasional Berhad Asnb I Invest

Unit Investment Trust Fund Flowchart Uitf Investing Stock Market Investing Trust Fund

Post a Comment for "Am Investment Unit Trust Get Free Info"