Alternative Investment Accreditation Find The Idea Here

Specialist independent investment continuing education accreditation and certification Login. A 506b offering can.

Alternative Investment Platforms 79 Ideas To Diversify And Profit

To be eligible to invest in these alternative investments one has to have an income of at least 200000 individual or 300000 joint for the last two years.

Alternative investment accreditation. These investments are often limited to institutional firms and high net worth accredited investors. Currently an accredited investor is anyone with income that exceeded 200000 or 300000 with a spouse in each of the. The Chartered Alternative Investment Analyst CAIA designation is a financial certification for investment professionals conferred by the Chartered Alternative Investment Analyst.

We are a member-driven organization representing professionals in more than 95 countries and advocating for the industry through our events publications and credential programs. Regulations limiting many kinds of alternative investments to accredited investors are meant to be both a sophistication test as well as a protective measure. These provisions allow them to raise an unlimited money of money via private placements so long as generally the investors are all accredited.

The ongoing post-tertiary development of knowledge skill and expertise resulting from a commitment to post-graduate continuous learning. More alternative investments are open to non-accredited investors than ever before. The SEC set the definition of the wealthy with their accredited investor definition.

Check out the full list of alternative investment platforms on Side Hustle Nation to learn. Crowdfunding portals typically rely on the investors ability to self-select deals that may or may not be appropriate for them. What alternative investments are open to non-accredited investors.

It is the antithesis of CPD points. While certain alternative investments are readily available to novice investors others are better left to those with experience in. Investors who want exposure to alternative assets seek investments outside of the traditional markets of stocks fixed income or cash.

Popular alternative investments include crowdfunded real estate precious metals fine art and angel investing. Additionally the rule states the investor expects that income to continue going forward. The global professional body dedicated to alternative investments seeking greater alignment transparency and knowledge for all investors.

Often referred as exempt securities alternative investments are not publicly traded and nor easily accessible in a similar fashion to stocks bonds or GICs. Most alternative investment assets are held by institutional investors or accredited high-net-worth individuals because of their complex nature lack of regulation and degree of risk. The goal is to.

Exploring crowdfunding for non-accredited investors can be a confusing experience. Alternative investment fund managers and platforms as we detail in another post typically take advantage of one of two possible exemptions from having to register their securities with the SEC. Continuing Education Accreditation and Certification.

Anyone licensed as a broker or investment advisor would also be accredited. Alternative investments are now easier to find for individual investors but crowdfunding websites often fail to incorporate two cornerstones of private investing. Theres a lot of new investment choices out there but the reality is that most of the marketing money being spent right now so most of the ads youve probably seen about equity crowdfunding and real estate is going toward Reg D platforms that are only available to what the SEC calls accredited investors.

Real Estate Crowdfunding Real estate can be an excellent way to add diversification to your portfolio and crowdfunding is an attractive alternative to a real estate investment trust REIT or. Non-accredited investors are now eligible to participate in many previously closed-off real estate investments business lending and other opportunities. Alternative investments are any asset-producing investment that isnt in stocks bonds or cash.

The curriculum is designed to provide finance professionals with a broad base of knowledge in alternative investments. 506b and 506c of Regulation D.

Alternative Investments 2020 The Future Of Capital For Entrepreneurs And Smes World Economic Forum

10 Alternative Passive Investments For Non Accredited Investors By Paulo Carvalho Medium

Alternative Investment Platforms 79 Ideas To Diversify And Profit

Investing In Alternative Assets Nanalyze

Core 1 Securities Managed Investments Stockbrokers And Financial Advisers Association

Private Placement Memorandum And Other Private Investment Documents Carofin An Alternative Investment Marketplace Powered By Carolina Financial Group

Guide To Alternatives J P Morgan Asset Management

Alternative Investing 101 Alternative Investments Are A Great Way By The Practical World Coinmonks Medium

10 Alternative Passive Investments For Non Accredited Investors By Paulo Carvalho Medium

10 Alternative Passive Investments For Non Accredited Investors By Paulo Carvalho Medium

Is It Worthwhile To Get The Chartered Alternative Investment Analyst Caia Designation Quora

Investing In Alternative Assets Nanalyze

Alternative Investment Platforms 79 Ideas To Diversify And Profit

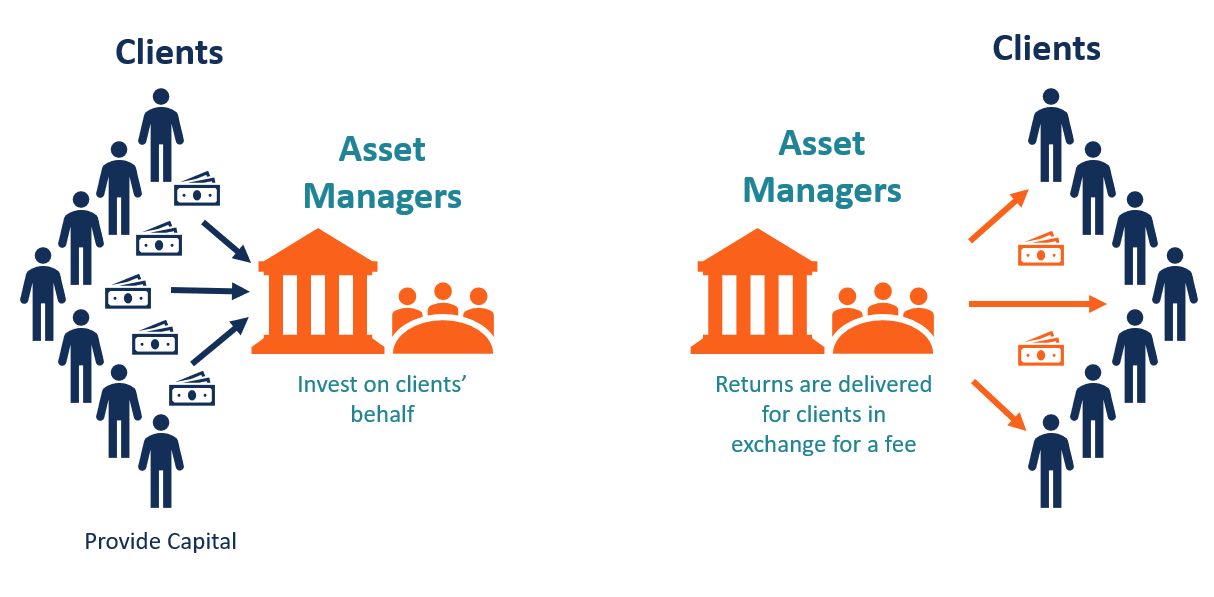

Asset Management Company Amc Overview Types Benefits

Investing In Alternative Assets Nanalyze

What Is An Accredited Investor Vs A Non Accredited Investor

Post a Comment for "Alternative Investment Accreditation Find The Idea Here"