Activist Investment Managers With Many Choices

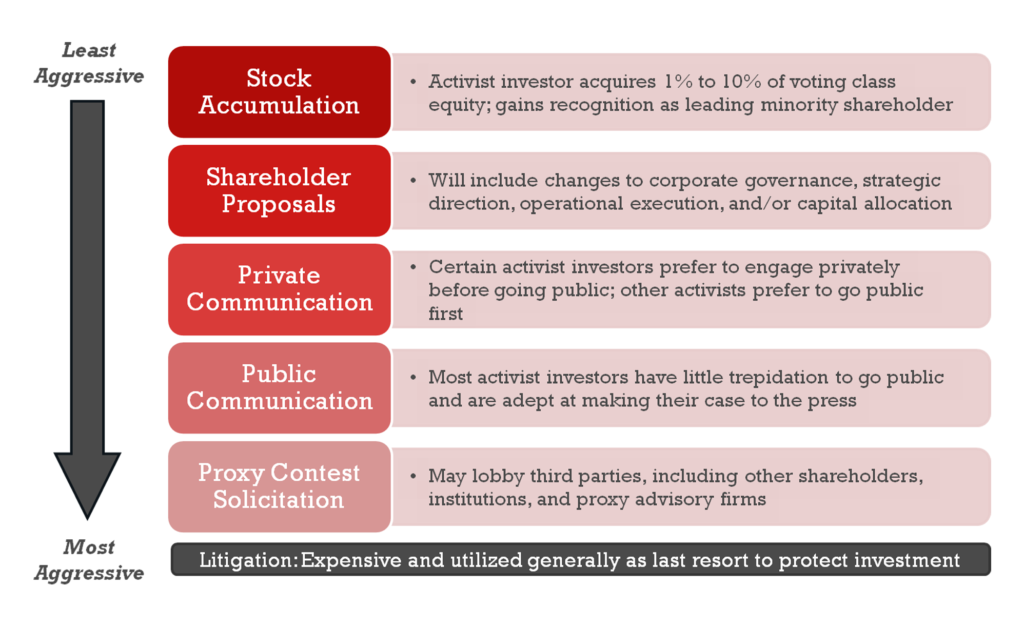

Activist alternative investment managers are relatively longer-term investors and are frequently structured as to provide patient capital. Investment managers fed up with a portfolio companys management and lack of progress have recognized that activist engagements can be a useful tool to catalyze the changes needed to deliver returns.

Pdf The Past Present And Future Of Shareholder Activism By Hedge Funds

Alternative investment funds hold activist investments for longer periods than is common in purely trading-oriented strategies -.

Activist investment managers. It is the management affiliate of American hedge funds Elliott Associates LP. These funds often believe that their role as fiduciaries for their investors requires them to sometimes pursue. Activist hedge fund Elliott Management has taken a multi-billion pound stake in GlaxoSmithKline the Financial Times reported on Thursday after a year that has seen the British pharma firm take.

A year-long rally in asset prices has made it harder to find hidden gems said Engaged Capital Chief Investment Officer Glenn Welling. It is also one of the largest activist funds in the world. Trends in Shareholder Activism Carl Icahn Bill Ackman Paul Singer and other activist investors have become almost household names.

Joe is a partner in our New York office. Even so the firm which has 15 billion under management. An activist shareholder attempts to gain control of a company in order to pressure its management into making changes or replace its management outright.

Of course activist investing isnt a new phenomenon so fund managers may want to explore its track record before embarking on this path. American billionaire investor Carl Icahn. Learn More About Us.

Our co-founders have worked together for a decade as activist investment managers and are supported by a leading team of experienced professionals. Activist investor Nelson Peltz is no stranger to the asset management industry. After Trian Partners made a solid return on its investment in Legg.

And Elliott International Limited. Mr Icahn Mr Ackman and their activist investing peers are no longer the only shareholders management has to be vigilant about showing up in the share register after a recent spate of campaigns by. He leads our work on activist investors globally and assists clients with a wide range of corporate-finance and investment issues.

And that isnt just because he owns a hedge fund. Resorting to the activist playbook. As detailed above increasing the reporting threshold for institutional investment managers from 100 million to 35 billion would reduce issuers insight into their investor base making it more difficult to discern the appropriate amount of time and resources necessary for direct engagement with shareholders that have requested to speak with management andor board of directors.

Impactive Capital is an activist investment management firm founded by Lauren Taylor Wolfe and Christian Alejandro Asmar. Joining us today to discuss the pros and cons of activist investors are Joe Cyriac and Sandra Oberhollenzer. Elliott Management Corporation is an American investment management firm.

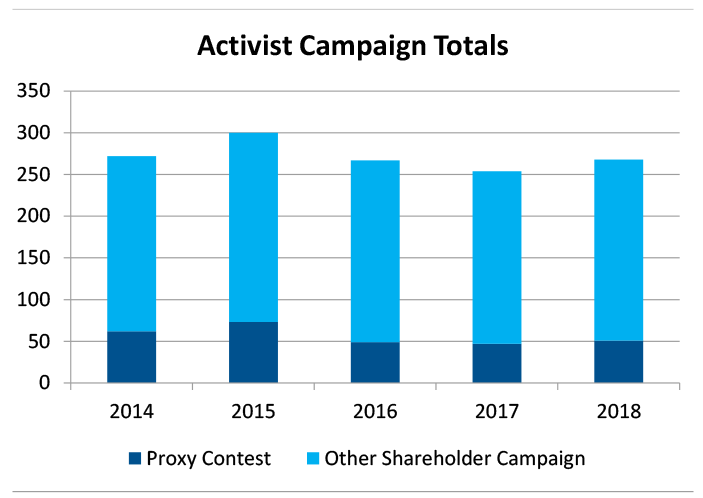

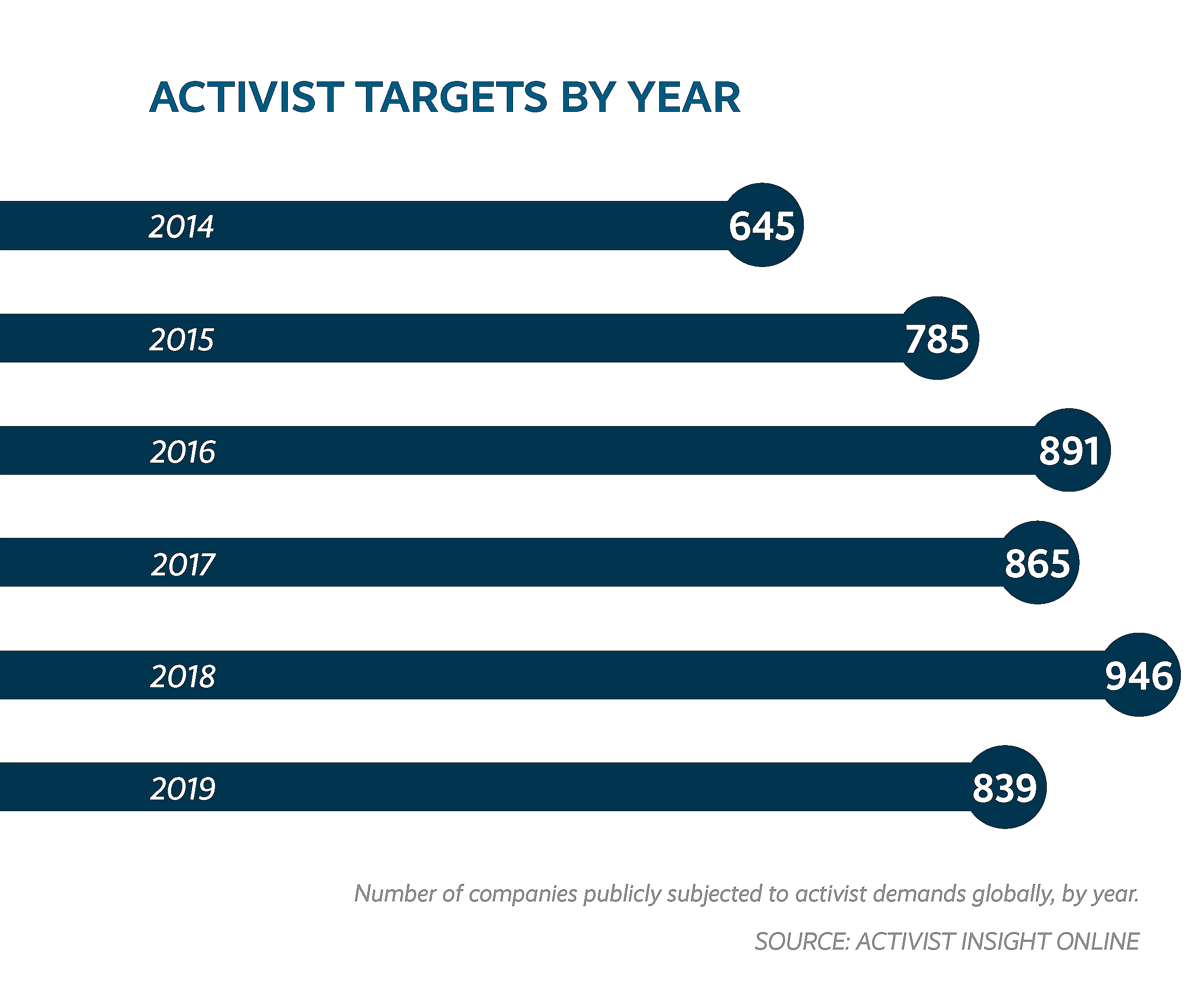

However the number of successful campaigns dropped by 15 in 2019 falling to 85 successful campaigns while the combined number of successful and settled campaigns was 149 showing a 24 drop in success rate for activist. As directors they could be charged with discerning where activist investors are proposing different approachesand with purposefully representing any alternate asset-deployment strategies. The Elliott Corporation was founded by Paul Singer who is CEO of the management company based in New York City.

Since CFOs dont own capital investments the way operating executives and the CEO might they can afford to be dispassionate third-party evaluators of investment flows and alternate investment. Activist investor shareholder activism hedge funds GlaxoSmithKline Elliott Management Emma Walmsley. Nonetheless the number of successful activist investor campaigns remained largely the same in 2018 from the previous year with 100 successful campaigns compared with 101 in 2017.

Pdf Activist Investors And Implications For Corporate Governance A Case Study Of Barington Capital Group And L Brands

Over Eager Activist Investors Are Partly To Blame For Mega Deal Failures Thestreet

Activist Investors And The Art Of The Deal Wsj

Pdf Shareholder Activism A Multidisciplinary Review

Forming Active Defence Against Activist Investors Fm

Shareholder Activism Who What When And How

Review And Analysis Of 2018 U S Shareholder Activism

Annual Review And Analysis Of 2019 U S Shareholder Activism

Activist Investor Definition Roles List Of Activist Investor

What Ceos And Boards Need To Know About Shareholder Activism

The Activist Investing Annual Review 2020

Https Www2 Deloitte Com Content Dam Deloitte Za Documents Finance Za Activist Investors Report Pdf

Pdf Shareholder Activism Driver Of Corporate Change Or Much Ado About Nothing

Are Activist Investors Bad For Businesses World Economic Forum

Post a Comment for "Activist Investment Managers With Many Choices"