Absolute Investment Management Performance Which is Very Interesting

Monash Investors is the Investment Manager of the Monash Absolute Investment Fund MAIF and since its inception on 2 July 2012 the Fund has achieved the Managers target rate of return after all fees with volatility lower than investing in the equity market as well as not losing capital over the medium term. The quartile rank is for the main unit within the sector.

Absolute Return Vs Relative Return What S The Difference

This may not include all funds available for retail investment in Australia.

Absolute investment management performance. This subject focuses on the investment management process including portfolio construction and performance management. The Bennelong Kardinia Absolute Return Fund is a longshort strategy investing in Australian equities. All of our funds have an absolute return objective.

Over rolling 3 year periods To preserve capital over rolling 3 year periods Diversified exposure to primarily Australasian equities complemented by selective exposure to international equities and cash A medium to high risk investment. Performance figures are after management and admin fees excl. Samuel Terry Asset Management is a boutique investment management company based in Sydney.

Our investment performance is driven by an alchemy of entrepreneurship hard work patience and the commitment to invest boldly on the basis of our convictions not our fears. Range of High Capital Growth High Income Yielding Fundamental Value Investing Funds. The latest fund information for Monash Absolute Investment Fund A including fund prices fund performance ratings analysis ratios manager information.

Our Listed Investment. The peer comparison figures have been sourced from Morningstar data and is therefore limited to the funds and investment products included in their database. We focus on the long-term commitments required to maximize the absolute.

Applying A Long-Term View On Investing For Over 145 Years. Total return performance figures are calculated on an exit price to exit price basis with net income distributions reinvested. An absolute return investment strategy A target return of the RBA cash rate 5 pa.

The peer calculation is. We keep our investment objective and focus on both growing and protecting our capital in the long-term. It aims to generate consistent positive returns in all market conditions with an overarching philosophy of capital protection.

It examines asset allocation approaches and the process of managing equity. Investment performance We measure the performance of each fund against the risk and return objectives of their investment mandates. Ad Investing With Clarity And Conviction With Insights Across Public And Private Markets.

Ad 5 Star Rated Morningstar Fund in its Category over 10 Years 4 Star Overall Rating. MCI Asset Management is an absolute return Fund and derives income via investing its own Proprietary Capital. Our objective is to generate double-digit.

The company was established in April 2004 and is owned by the family trusts of Fred Woollard and Nigel Burgess. Fund Introduction Monthly Fact Sheet. We were founded on the premise that alignment between a fund manager and its investors is crucial.

Brokerage and assuming dividends re-invested and no withdrawals. Ad Investing With Clarity And Conviction With Insights Across Public And Private Markets. Our business and our funds are structured and managed within this.

NAOS Asset Management is a specialist fund manager providing genuine concentrated exposure to Australian Listed Industrial Companies outside of the ASX-50. Applying A Long-Term View On Investing For Over 145 Years. With a proven performance track record NAOS seeks to protect investor capital whilst providing a sustainable growing stream of fully franked dividends and long-term capital growth above the relative benchmark index.

We manage a fund the Samuel Terry Absolute Return Fund that invests in a portfolio of equity and debt securities in Australia and internationally. Pengana Capital Group Pengana is a diversified funds management group with distinct investment strategies that aim to deliver superior long-term risk-adjusted returns to investors with a focus on capital preservation. Performance figures are shown in Australian dollar AUD.

Fund managers who measure their performance in terms of an absolute return usually aim to develop a portfolio that is diversified across asset classes geography. Performance as at 31032021.

Milford Asset Management I Investment Specialists

Hedge Funds Higher Returns Or Just High Fees

How Do We Measure Investment Performance By Farhad Malik Fintechexplained Medium

Absolute Return Vs Relative Return What S The Difference

Nanuk Asset Management Specialist Investment Management Firm

Pricing And Performance Perpetual

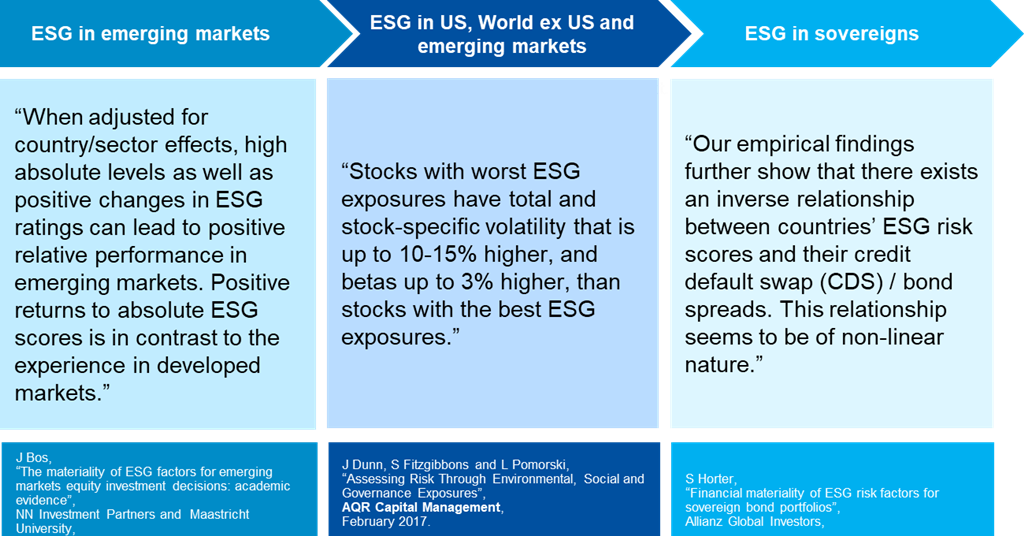

Four Areas Of Misunderstanding Around Esg Integration Blogs Pri

Absolute Return Meaning Formula How This Strategy Works

Value Fund Manager Ajo To Shut Down After Losses Financial Times

Home Daintree Capital Boutique Investment Management

Logica Capital Up 21 Ytd March 2020 Commentary Is It Different This Time Value Investing March Month Investing

Absolute Return Vs Relative Return What S The Difference

Don T Be Fooled By Absolute Returns Wealthfront Blog

Hedge Funds Higher Returns Or Just High Fees

Post a Comment for "Absolute Investment Management Performance Which is Very Interesting"