2013 Investment Income Surtax With Many Choices

Net Investment Income Tax 38 Medicare Surtax Net Investment Income Tax 38 Medicare Surtax 2021-01-09 Since January 1 2013 a 38 Medicare tax known formally as the Net Investment Income Tax NIIT aka Medicare surtax applies to certain investment income of individuals estates and trusts that exceed statutory threshold amounts. NEW YORK – Starting in 2013 high-income taxpayers will face a 38 tax on their net investment income the net investment income tax or NIIT.

Taxation And Its Negative Impact On Business Investment Activities Institut Economique Molinari

For individuals the tax is imposed on the lesser of the following two amounts.

2013 investment income surtax. Net Investment Income Tax Regulations Affecting S Corporations By Michael Kosnitzky and Michael Grisolia Michael Kosnitzky and Michael Grisolia examine the use of S corporation structures to limit Net Investment Income Tax NIIT. 1 Heres what you need to know. 9 Attributed personal services income00 O 0000 5 of amount B in lump sum payments box H 00 3 Employer lump sum payments00 TYPE Amount A in lump sum.

The trustee is now trying to decide if a distribution of trust accounting income should be made to the trust beneficiaries. The statutory threshold amounts are. For more information refer to Non-lodgment advice.

TrustEstate Distribution Example During the 2013 tax year the Smith Family Trust had 100000 of net investment income and 19900 of deductible expenses. Because the highest tax bracket for a trust is 11950 in 2013 the net investment income subject to the surtax is 438050 450000 11950. Page 2 Sensitive when completed INDIVIDUAL TAX RETURN 0 00Total tax withheld Add up the boxes.

If you do not need to lodge a tax return for the 201213 income year you will need to notify us of this. The NIIT is an extra tax that is imposed in addition to your regular income tax says Scott Weiner senior tax analyst at Thomson Reuters. O n December 5 2012 the IRS promulgated proposed regulations Proposed Regula-tions1 providing guidance under Code Sec.

The NIIT is imposed at the individual trust and estate level and is paid in addition to any regular and AMT tax. To lodge your 2013 tax return by mail you can use the paper Tax return for individuals and the Individuals tax return instructions. Effective January 1st 2013 a new 38 Medicare surtax applies to all taxpayers whose income exceeds a threshold amount.

1 your excess MAGI of 200000 450000 – 250000 threshold for joint. The surtax is imposed in addition to all other taxes imposed by the Internal Revenue Code including the alternative minimum tax. Individual tax return 2013 1 July 2012 to 30 June 2013 Please print neatly in BLOCK LETTERS with a black or blue ballpoint pen only.

The excess of an individuals modified adjusted gross income over specific thresholds 200000 for single filers and 250000 for joint Net investment income is. 1 2013 individual taxpayers are liable for a 38 percent Net Investment Income Tax on the lesser of their net investment income or the amount by which their modified adjusted gross income exceeds the statutory threshold amount based on their filing status. Estates and trusts with undistributed net investment income and AGI above the dollar amount at which the highest tax bracket for an estate or trust begins for that tax year are also subject to the net investment income tax.

Remember that is applies to investment income not wages. Its been around since 2013 but many are still struggling to come to grips with the net investment income tax. 1411 was created as.

New 38 Investment Tax The 38 tax increase will be on investment income which includes capital gains and dividends for filers married filing jointly earning over 250000 per year and for single filers earning over 200000 per year. What were going to do today is talk about the new investment surtax. Completing your 2013 individual income tax return.

Married filing jointly 250000. The net investment income tax is a 38 surtax that is paid in addition to regular income taxes. But not everyone who makes income from their investments is impacted.

Beginning January 1 2013 a 38 surtax is placed on certain investment income for individuals trusts and estates. This new surtax in essence raises the marginal income tax rate for many of your clients. The 38 tax which is sometimes referred to as the Medicare surtax on net investment income affected approximately 31 million federal income tax returns for 2013 the only year for which data is available to the tune of almost 117 billion.

Beginning January 1 2013 Obamacare through the enactment of Section 1411 — will impose upon certain high earners a brand spankin new 38 tax. The net investment income tax is a 38 surtax on a portion of your modified adjusted gross income MAGI over certain thresholds. Net investment income or 2.

It is generally paid by high earners with significant investment income. You will owe the 38 Medicare tax on all 150000 of your net investment income because that amount is the lesser of.

Income Tax And Capital Gains Rates 2018 Skloff Financial Group

Why The Rich Hate Obamacare A Reverse Cap Tax On Their Investment By Don Lehman Jr Medium

Income Tax And Capital Gains Rates 2021 Skloff Financial Group

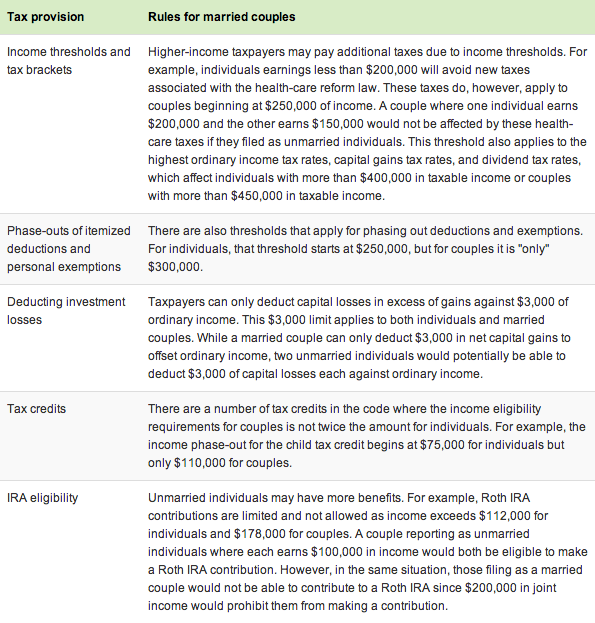

Doma Ruling Means New Benefits For Same Sex Couples Putnam Wealth Management

Net Investment Income Taxes Archives Skloff Financial Group

The 3 8 Medicare Surtax Ellevate

Http Www Institutmolinari Org Img Pdf Note0315 En Pdf

How To Avoid The Surtax On Investment Income Marketwatch

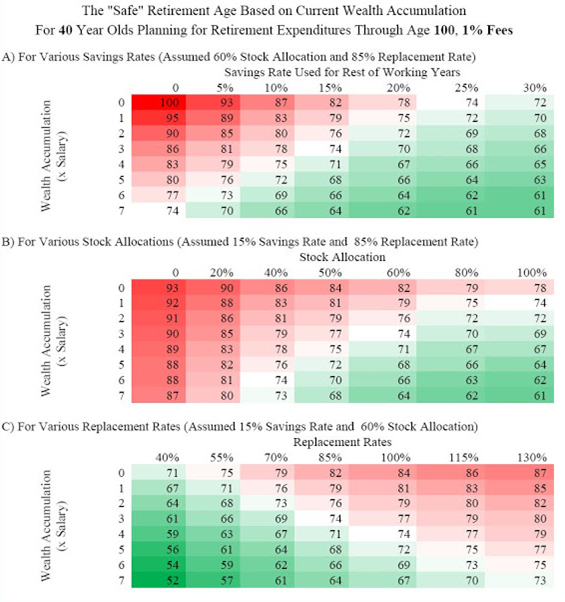

Establishing Your Top 10 Investment Default Settings Above The Market

Grouping Elections And The Net Investment Income Tax Medicare Surtax

What The Senate S 3 8 Surtax Means For American Taxpayers Fox Business

I Fire Clients Everyone Is Always Surprised When They Hear That So Why Do I Do It Http Www Fraimcpa Com Why I Fire Clients Dumb And Dumber Coworker Fire

The Obama Tax Hikes What To Do

Capital Gain Long Term Tax Rate 2017 Rating Walls

Tax Loss Harvesting Fidelity Tax Deductions Capital Gain Tax Brackets

Income Tax And Capital Gains Rates 2016 Skloff Financial Group

How Ira Withdrawals Can Trigger 3 8 Medicare Surtax

Why The Rich Hate Obamacare A Reverse Cap Tax On Their Investment By Don Lehman Jr Medium

Post a Comment for "2013 Investment Income Surtax With Many Choices"