1980 Investment Tax Credit With Many Choices

F For certified property acquired primarily for use in a prescribed area after October 28 1980 and before January 1 1987 a special investment tax credit rate of 50 is in effect. Scheduled for a hearing before the Committee on Ways and Means on April 15 1980.

.png)

Property Vs Shares The Long Term Verdict Westpac

Effects of a temporary increase in t p.

1980 investment tax credit. The Windfall Profit Tax Act of 1980 PL. Department of Commerce Bureau of Economic Analysis See text for details. Consolidated Omnibus Budget Reconciliation Act of 1985.

You sell an investment property and make a 100000 profit after all deductions You add 100000 to your taxable income for the year The ATO would then tax you as if. Hi i recently sold an investment property that was purchased in march 1998 and sold sept 2017 I bought it for 94000 inc expenses and sold it for 340000 and minus expenses collected 320000. Accounting Treatment of the Investment Tax Credit and Accelerated Depreciation for Public Utility Ratemaking Purposes.

He believed higher levels of capital formation would raise productivity keep people employed and alleviate a serious balance of pay-. 6806 relating to accounting treatment of the investment tax credit and accelerated depreciation for public utility ratemaking purposes. Rights and options to acquire shares or units.

If youre an Australian resident CGT applies to your assets anywhere in the world. 1001 75 50 25 N Manu-43 Construction Finance. The act delayed decreasing in the investment tax credit through 1980.

The investment tax credit which was tax-able was 10-25 percent of current and capital spending on RD the percentage varying with the size of the firm and the location of its RD activity. While a temporary investment tax credit reduces q by less than a permanent credit the temporary credit leads to a short-run boom in investment as firms attempt to increase investment before the credit expires. Delayed decrease in investment tax credit from 10 to 7 through 1980.

Extended research and experimentation credit. Acquiring rights or options. It expanded the individual minimum tax and increased the long-term capital gains holding period from 6 months to 1 year.

When an amount of investment tax credit has been deducted from a taxpayers tax payable for the year of death or a previous year the rule in paragraph 121t as modified by paragraph 701b applies. Repealed the investment tax credit and lengthened capital cost recovery periods. The Tax Reform Act of 1986 was the top domestic priority of President Reagans second term.

Hearing Before the Committee on Ways and Means House of Representatives Ninety-sixth Congress Second Session on HR. Investment Tax Credit on Corporation Returns 1980 Figure A Percent of Total Investment Used for Investment Tax Credit by Selected Industry 1974 and 1980 1974 Total Nonfarm 1980 Mining Source. I have been trying the cgt calculators and getting figures ranging from 38000 to 50000 Is this the figure i will pay the tax office or is this a figure that.

A unified rate schedule for the estate and gift taxes with a 175000 exemption was created. I am a little confused about the cgt. Investment Tax Credit Enacted 1962.

Non-assessable payments in relation to shares and units. ITC was first introduced in RA626 President Kennedy advocated enacting the credit to stimulate capital formation. Company non-assessable payments CGT event G1 Trust non-assessable payments CGT event E4 AMIT non-assessable payments CGT event E10 Bonus shares.

The act lowered federal income tax rates decreasing the number of tax brackets and reducing the top tax rate from 50 percent to 28 percent. The special research allowance permitted firms to deduct from their taxable income an amount equal to 50 percent of the. Investment tax credit 7.

The IMF has released end-2019 results of the Coordinated Direct Investment Survey CDIS. So if you sign a contract to sell an investment property in June 2017 and settle in August 2017 you need to report the capital gain or loss in your 201617 tax return. During the decade of 1972-1981 the credit grew almost six-fold increasing to nearly 4 billion for Tax Year 1981.

RD investment tax credit and a special research allowance during the early 1980s. Managed investment fund trust distributions. Cost of Property Data-Internal Revenue Service Total Investment Data-US.

Investment Tax Credit for Individual Taxpayers 1981 By Jon Maiden and David Paris The rate of growth of the investment tax credit claimed on individual income tax returns has been signficant in terms of both the amount claimed and the number of individuals claiming this credit. Table 2 summarizes these short-run effects of changes in t c t p t g and Γ on I q and the cost of. The amount is required to be included in the taxpayers income for the year of death to the extent that the amount was not included in income under paragraph 121.

3165 April 15 1980 Issue 96 Part 87 of Serial 96th Congress United States Congress. The CDIS is a global survey of cross-border direct investment holdings with immediate counterpart country information. The Tax Reform Act of 1986 TRA was passed by the 99th United States Congress and signed into law by President Ronald Reagan on October 22 1986.

Initiated new low-income housing tax credit and phased in deductibility of health insurance costs of self-employed individuals. The Revenue Act of 1962 RA62 represents a landmark in terms of tax incentives for investment. Tax credits for solar and wind energy property investments were extended for three years through 1985.

Further tightened state volume limitations for private purpose tax-exempt bonds. E For qualified expenditures made in 1985 and subsequent taxation years further restrictions apply for certain corporations to be eligible for a 35 credit. The new data show that the US holds both the largest inward direct investment position with 45 trillion and the largest outward direct investment position with 60 trillion.

96-223 substantially expanded the energy credit to further the objective of developing an abundant range of energy resources and promoting investment in energy conservation. Additionally the credit rate for solar and wind was increased to 15 and.

Chapter 9 Sources Of Government Revenue 1 Key Terms 2 Sin Tax Incidence Of A Tax Tax Loophole Individual Income Tax Sales Tax Benefit Principle Ppt Download

Chapter 26 Savings Investment Spending And The Financial

Https Www Jstor Org Stable 40040294

2 The Impact Of Fiscal Policy On The Balance Of Payments Recent Experience In The United States Fiscal Policy Economic Adjustment And Financial Markets

A Brief History Of Australia S Tax System Treasury Gov Au

A Brief History Of Australia S Tax System Treasury Gov Au

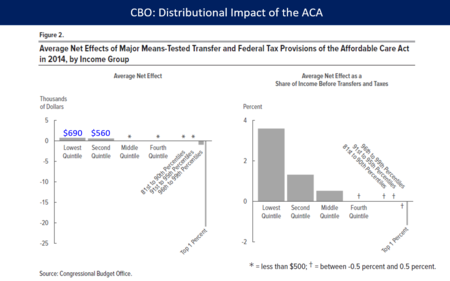

Tax Policy And Economic Inequality In The United States Wikipedia

Tax Policy And Economic Inequality In The United States Wikipedia

Https Fas Org Sgp Crs Misc If10479 Pdf

9 Tips For Investors During Covid 19 Recovery Amp

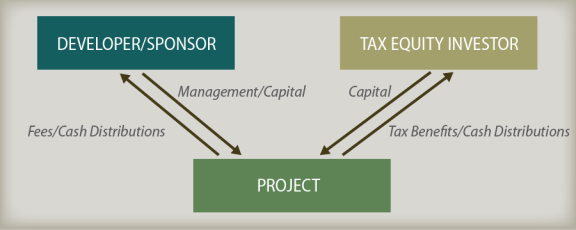

Tax Equity Financing An Introduction And Policy Considerations Everycrsreport Com

Https Www Jstor Org Stable 2586987

Here S How An Obscure Tax Change Sank Puerto Rico S Economy

A Brief History Of Australia S Tax System Treasury Gov Au

Tax Policy And Economic Inequality In The United States Wikipedia

South Korea Direct Investment Abroad 1980 2021 Data

International Trends In Company Tax Rates Implications For Australia S Company Income Tax Treasury Gov Au

Post a Comment for "1980 Investment Tax Credit With Many Choices"