1940 Investment Company Act Summary Which is Very Interesting

The regulation is designed to minimize conflicts of interest that arise in these complex operations. Regulations Under the Acts.

Https Heinonline Org Hol Cgi Bin Get Pdf Cgi Handle Hein Journals Stabf7 Section 6

Are ETFs regulated by the Investment Company Act of 1940.

1940 investment company act summary. 2702a-1 Valuation of portfolio securities in special cases. Nized group of persons whether incorporated or not. In terms of actually operating the fund the Investment Company Act of 1940 requires that funds limit the use of leverage and must include a cash bufferin the case of mutual fundsfor those investors wishing to redeem their shares at any time.

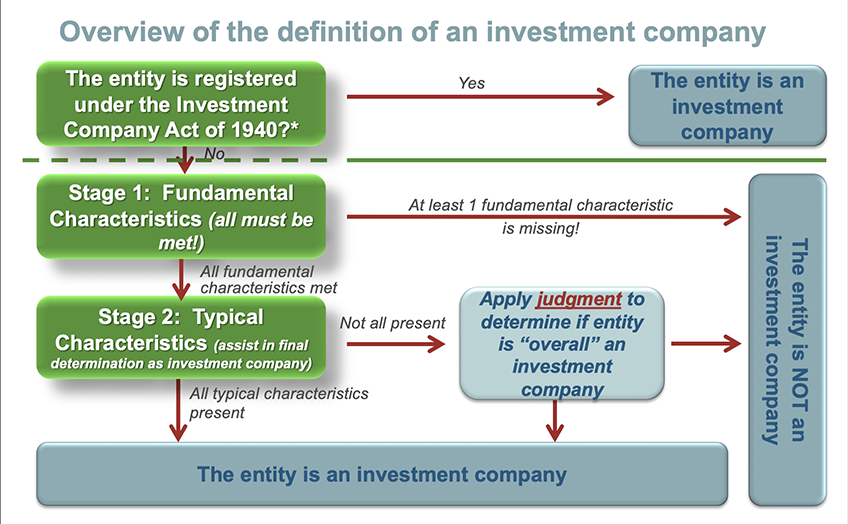

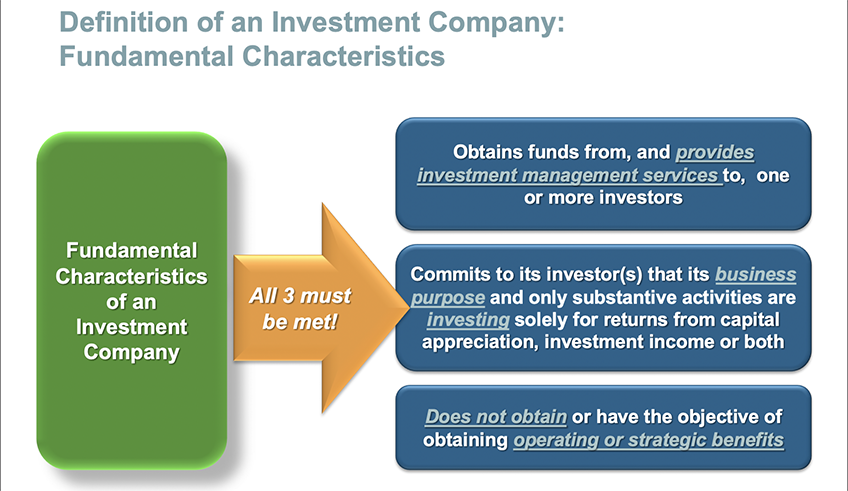

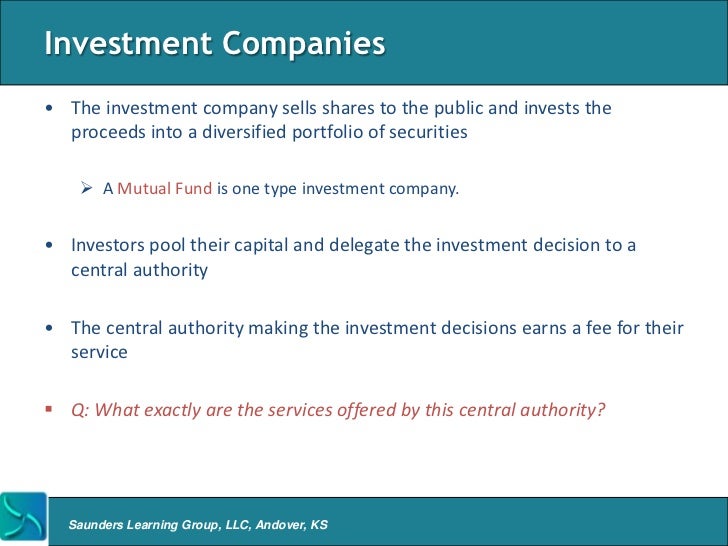

If determined to be an investment company the company is subject to the full regulation under the act. Investment Company Act of 1940 This Act regulates the organization of companies including mutual funds that engage primarily in investing reinvesting and trading in securities and whose own securities are offered to the investing public. The Investment Company Act of 1940 regulates mutual funds and other companies that engage primarily in investing reinvesting and trading in securities and whose own securities may be offered to the investing public 15 USC.

Investment Company Act of 1940 as amended ICA Also known as the 40 Act or the ICA. Or any re ceiver trustee in a case under title 11 of the United States Code or similar official or any liquidating agent for any of the foregoing in his capacity as such. An understanding of the Investment Company Act.

The regulation is designed to minimize conflicts of interest that arise in these complex operations. Investment Company Act of 1940 This Act regulates the organization of companies including mutual funds that engage primarily in investing reinvesting and trading in securities and whose own securities are offered to the investing public. Investment Company Act of 1940.

An investment company is a company whose main business is holding securities of other companies purely for investment purposes. 80a-1 to 64. Investment Company Act Of 1940 Summary.

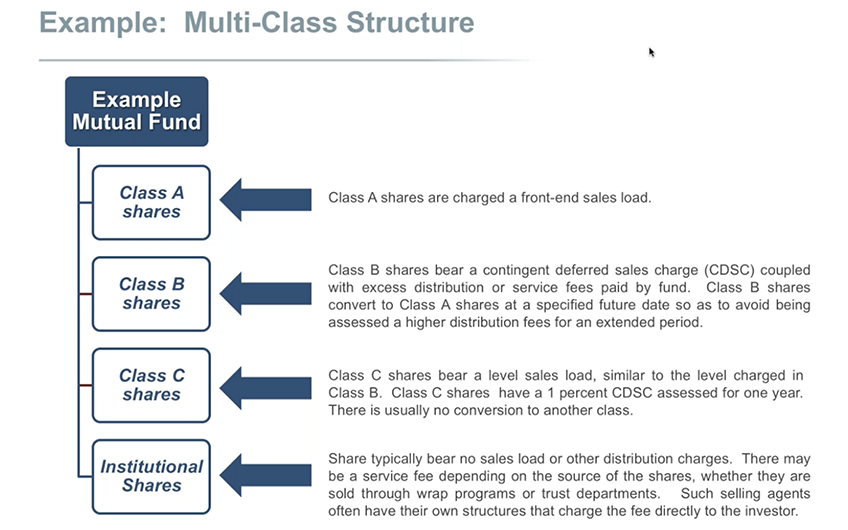

Regulation ATS 17 CFR. 1 the history of the investment company in-dustry in this country with the general nature of the abuses to which it had been subject. Investment company a financial institution that sells shares to individuals and invests in securities issued by other companies.

Investment Advisers Act of 1940. The Investment Company Act provides very strict regulations for entities which are investment companies such as mutual funds. Federal law that defines the role and responsibilities of an investment advisoradviser.

While hedge funds do fall within the definition of investment company they will seek an exemption from the registration provisions. Of 1940 calls for a recognition of three important factors contributing to its composition. One of the worse situations a company may face to be determined to be an investment company under the Investment Company Act of 1940 as amended the act.

2 the pattern of recent federal legislation and particularly regulatory legislation whose enforce-ment has been. 5 INVESTMENT COMPANY ACT OF 1940 Sec. This Act regulates the organization of companies including mutual funds that engage primarily in investing reinvesting and trading in securities and whose own securities are offered to the investing public.

2700-10 Small entities under the Investment Company Act for purposes of the Regulatory Flexibility Act. Rules and regulations promulgated under the Investment Advisers Act of 1940 17 CFR Part 275 Forms prescribed under the Investment Advisers Act of 1940. The Investment Company Act of 1940 is an act of Congress which regulates the organization of investment companies and the activities they engage in and sets standards for the investment company.

9 Control means the power to exercise a controlling in fluence over the management or policies of a company. Impetus for passage of the act began with the Public Utility Holding Company Act of 1935 which authorized the Securities and Exchange Commission SEC to study investment trusts. The Act requires these companies to disclose their.

Forms prescribed under the Investment Company Act of 1940. 2700-11 Customer identification programs. Summary The Investment Advisers Act IAA was passed in 1940 to monitor those who for a fee advise people pension funds and institutions on investment matters.

The Investment Company Act of 1940 the Investment Company Act is what gives structure to the hedge fund industry. The investment company invests money on behalf of its shareholders who in turn share in. Sarbanes-Oxley Act of 2002.

Dodd-Frank Wall Street Reform And Consumer Protection Act. 2702a-2 Effect of eliminations upon valuation of portfolio securities. The Investment Advisers Act of 1940 is a US.

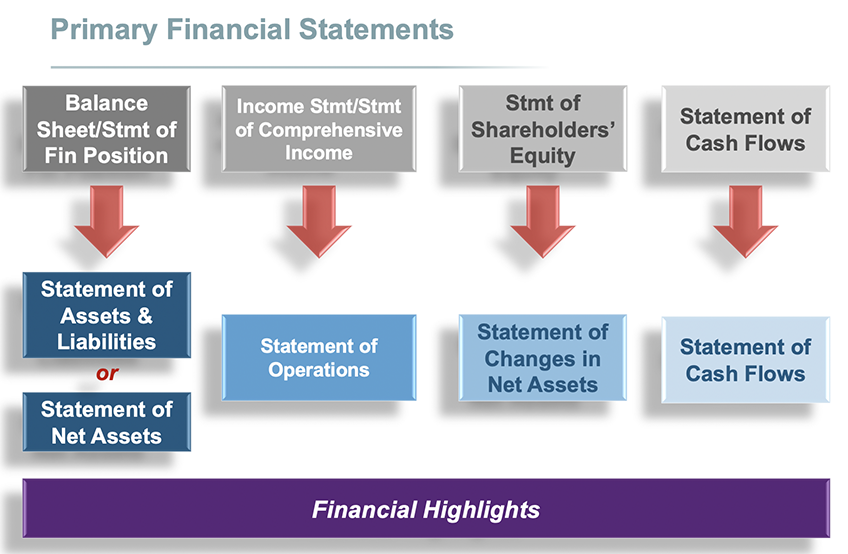

Accounting For Investment Companies Under Asc 946 An Overview Gaap Dynamics

2010 Investment Company Fact Book Pdf

Http Scholarship Law Upenn Edu Cgi Viewcontent Cgi Article 5272 Context Penn Law Review

Investment Company Act Of 1940 Securities Lawyer S Deskbook

Accounting For Investment Companies Under Asc 946 An Overview Gaap Dynamics

Accounting For Investment Companies Under Asc 946 An Overview Gaap Dynamics

Https Www Sec Gov Comments 4 725 4725 5658296 185774 Pdf

Accounting For Investment Companies Under Asc 946 An Overview Gaap Dynamics

Venture Capital Fund Flowchart For Exemption Under The Investment Advisers Act Of 1940 The Venture Alley

Https Www Clearygottlieb Com Media Files Investment Company Act Status Of Nonus Issuersupdated Commentary On Bookentry Deposit Procedures Und Pdf

Accounting For Investment Companies Under Asc 946 An Overview Gaap Dynamics

Are Robo Advisors An Investment Company Under Rule 3a 4

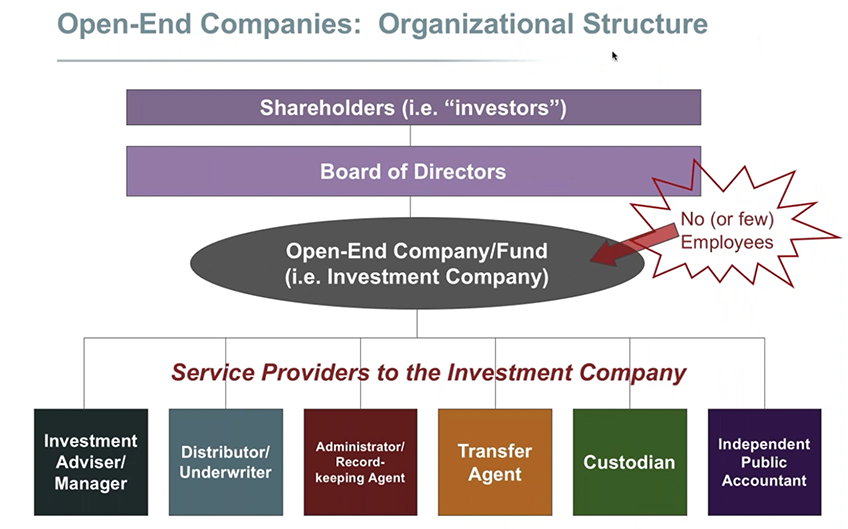

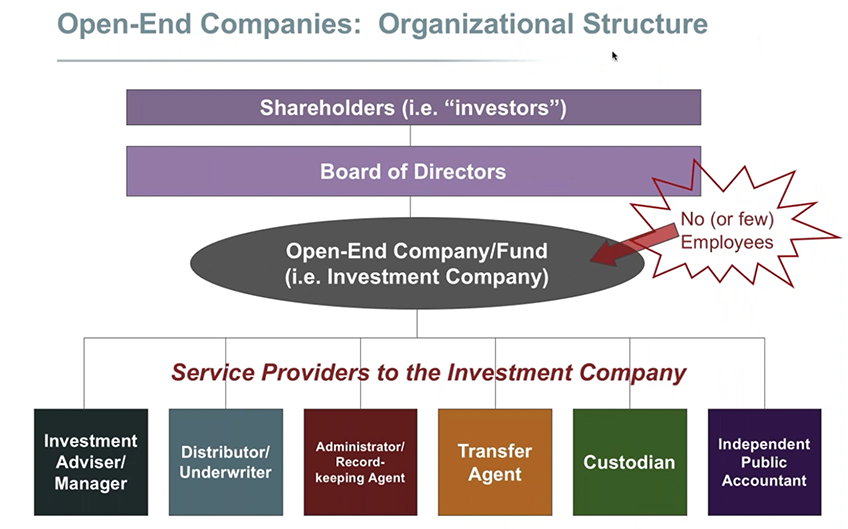

Understanding The Role Of Mutual Fund Directors Investment

Accounting For Investment Companies Under Asc 946 An Overview Gaap Dynamics

Investment Companies Are Special So Is Their Accounting Gaap Dynamics

What Is The Investment Company Act Of 1940

:max_bytes(150000):strip_icc()/shutterstock_345768812_dutch_netherlands_bank-5bfc326546e0fb0051bf1ee5.jpg)

Post a Comment for "1940 Investment Company Act Summary Which is Very Interesting"