1603 Investment Tax Credit For Renewable Energy Best of 2021

But they have a less-prominent sister incentive. 1 The 1603 Program reimburses eligible applicants for part of the cost of installing specified energy property used in a trade or business or for the production of income after the energy property is placed in service.

How Solar S Itc Tax Credit Is A Money Maker Greentech Media

In addition to other restrictions taxpayers upon accepting the Section 1603 grant elect not to claim an investment tax credit for qualifying facilities placed into service.

1603 investment tax credit for renewable energy. In addition Section 1603 of the American Recovery and Reinvestment Act provides cash grants for qualifying renewable energy facilities. Focusing on Federal Tax Credits and the Section 1603 Cash Grant. To remedy the situation many countries are pressing for.

Determining the basis in the. Barriers to Development Kevin M. It is worth noting that 1603 Cash Grants were effectively a substitute for ITCs so investment-based subsidies were in fact very large if ITCs and 1603 Cash Grants are considered together.

This was followed by investment tax credits at 24 billion or 513 of the total. The Section 48 Investment Tax Credit Today and the 1603 Treasury Program A commercial solar ITC is currently available to businesses that install qualifying solar energy property providing a dollar-for-dollar credit against federal tax liability in the taxable year in which the property is placed into service. The Section 48 commercial solar investment tax credit ITC provides for a credit equal to 30 percent of the basis of eligible property that a company places in service during the period 2006 through 2016.

The solar investment tax credit ITC is a tax credit that can be claimed on federal corporate income taxes for 30 of the cost of a solar photovoltaic PV system that is placed in service during the tax year1 Other types of renewable energy are also eligible for the ITC but are beyond the scope of this guidance To be eligible for the 30 ITC a solar PV system must have commenced. New markets tax credit NMTC. Investment Tax Credit ITC ARRA Section 1603 Renewable Energy Grants Other Tax Benefits Depreciation 5 year Modified Accelerated Cost Recovery System MACRS depreciation deductions Bonus Depreciation.

The 1603 Program revived the renewable energy industry in 2009 when the lack of tax equity financing in late 2008 brought many projects to a halt. PTCITCGrant – Options Projects must choose between these available benefits PTC is based on energy sold 22 centskWh for 2011 ITC is 30 of cost of. The Energy Production Tax Credit3 or the Energy Investment Tax Credit4 on the same property.

The investment tax credit ITC production tax credit PTC and 1603 Treasury cash grant get a lot of attention for their importance in spurring renewable energy project development. A Department of Energy analysis of the Section 1603 grant program which was available from 2009-2011 showed that it led to up to 75000 new jobs and 44 billion in total market growth. ARRTA also created a new grant program Section 1603 Program allowing applicants to elect to receive a cash grant from the.

Incentives for renewable energy generation including a production tax credit under section 45 PTC and an investment tax credit under section 48 ITC. Based on worldwide oil consumption rates some experts estimate that oil may be exhausted within the next fifty to one hundred years. The Section 1603 Program has disbursed over 26 billion to help fund 109766 clean energy projects that are estimated to produce enough clean energy to power over 85 million homes.

The awards vary in size ranging from 18000 to over 500 million and include projects located throughout the United States and the US. Lastly MACRS incentives were worth 18 billion or 397 of the total. Sections 45 and 48 of the Internal Revenue Code provide energy tax credits for qualifying renewable energy facilities such as wind solar and geothermal power plants.

ARRTA modified section 48 to allow taxpayers to claim an ITC in lieu of a PTC with respect to certain property. Walsh Renewable energy sources are the wave of the future. The proposal would extend for two years through 2012 and codify the direct payment in lieu of tax credit program that was initially created by Section 1603 of the American Recovery and Reinvestment Act of 2009 for renewable energy facilities eg wind solar and biomass facilities combined heat and power facilities fuel cells and microturbines that qualify for the production tax.

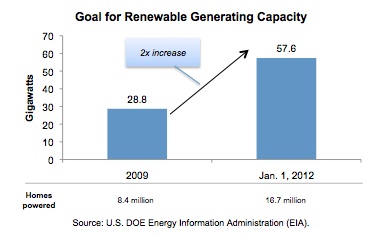

Congress enacted Section 1603 of the American Recovery and Reinvestment Act of 2009 the Section 1603 Program during the economic recession. For renewable energy in 2009 Congress enacted a temporary provision under Section 1603 of the American Recovery and Reinvestment Act whereby energy projects could receive a 30 percent cash grant from the Department of the Treasury instead of. As of January 2012 the 1603 Treasury Program awarded 4024 grants for more than 22000 solar projects totaling 176 billion and supported over 41 billion in private sector investment in 47 states.

5 Investment tax credits lower the user cost of capital by reducing the. Department of the Treasury 1500 Pennsylvania Ave NW. Daniel Steinberg Gian Porro and Marshall Goldberg Preliminary analysis of the jobs and economic impacts of renewable energy projects supported by the 1603 Treasury Grant Program.

A tax credit is a dollar-for-dollar reduction in the income taxes that the person claiming the credit would otherwise have to pay the federal government. Renewable Energy Financial Incentives. Mon-Fri 800am – 500pm.

Green Energy From The Sun Solar Thermal Solar Solar Water Heating System

How The Solar Tax Credit Makes Renewable Energy Affordable

Https Www Bakermckenzie Com Media Files Insight Publications 2018 04 Global Renewable Energy Conference Resources Speakers Global Renewableenergyconference Apr2018 Pdf La En

Promoting Clean Renewable Energy Investments In Wind And Solar The White House

Renewable Energy In California What Has Policy Brought Us Cpi

Claim Your 30 Solar Investment Tax Credit Itc Solar Electric Contractor In Seattle Wa 206 557 4215 Solar Tax Credits Renewable Energy Systems

Solar Panels Cities Shanghai Bund Skyline Landmark Ecological Energy Renewable Sponsored Paid Paid Cities Solar Bund Shanghai

Poster Renewable Energies Technologies By Shagiie Deviantart Com On Deviantart Renewable Energy Technology Renewable Energy Design Uses Of Solar Energy

The True Cost Of Renewable Energy Life Powered

Why Go Solar There Are So Many Reasons Why Solarpower Is The Way To Go Call Us Today At 877 520 7652 Solar Energy Diy Solar Energy Facts Renewable Energy

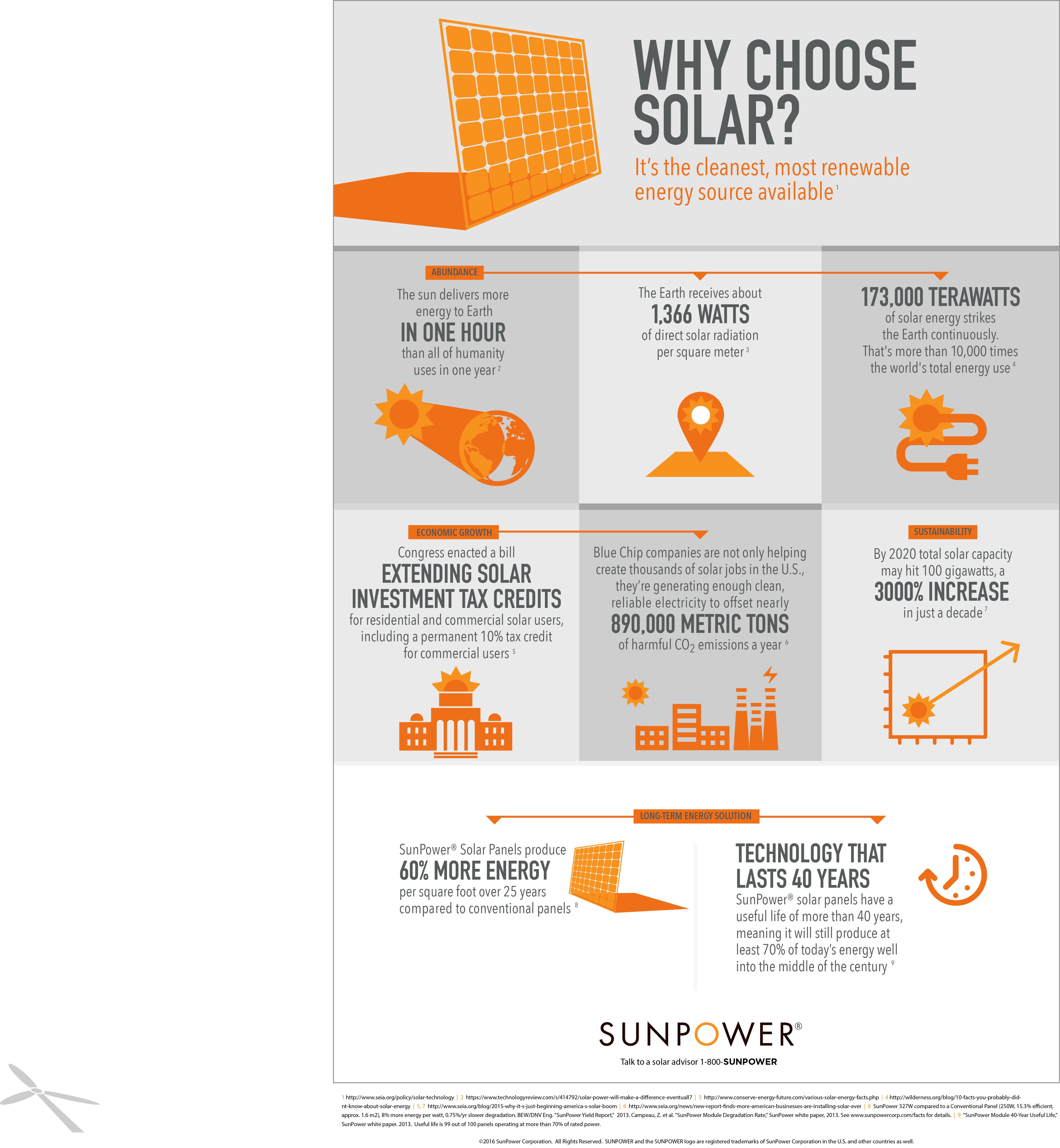

Infographic Cool Facts About How Solar Energy Works Sunpower Solar Blog How Solar Energy Works Solar Energy Solar Energy Diy

Promoting Clean Renewable Energy Investments In Wind And Solar The White House

Understanding Safe Harbor For Extending Your 30 Percent Solar Itc Qualification Renewable Energy World

Renewable Energy Is Now The Cheapest Option Even Without Subsidies Solar Energy Solar Electricity Cost

Solar Energy Google Search What Is Solar Energy Solar Energy Photovoltaic Energy

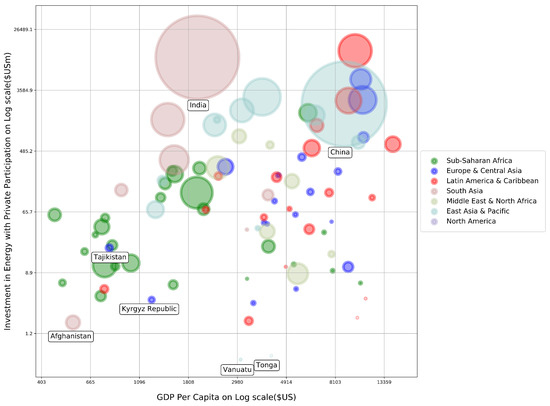

Sustainability Free Full Text Assessing Private Investment In African Renewable Energy Infrastructure A Multi Criteria Decision Analysis Approach Html

Hiring A Solar Installer Contractor Checklist Modernize Solar Energy Solar Panels Solar

Post a Comment for "1603 Investment Tax Credit For Renewable Energy Best of 2021"